Inside how a broker ‘shops the market’.

Life insurance is a competitive market in Ireland .

(This subject also applies to investments & pensions but I will focus on life cover for brevity)

There are just five life companies in the Irish market, with nearly every life company price matching each other, no matter which provider you choose, the rate will be the same. All 5 life companies are reputable & financially stable. With all policies priced the same, how do brokers choose which is best for you and does it matter? -Spoiler, yes it does!

If you work with a (good) broker, they will use comparison software to sift through all of the life insurance contracts offered and read through the (mind numbing) 40 plus pages of jargon to understand the pros and cons of each contract in the current market.

While I encourage everyone to read and understand their policy, it would take many hours of research for you to find the policy best suited to your needs -and it is quite literally a broker’s job to do so.

Note: (good) brokers will not cost you a cent more than the online ‘low cost’ providers and likely quite a bit less than purchasing through the bank. Banks and many online sites are tied agents, they are not brokers. Purchasing through a “tied agent” means the adviser will only have access to one of the 5 life companies in the market.

Policy details are important.

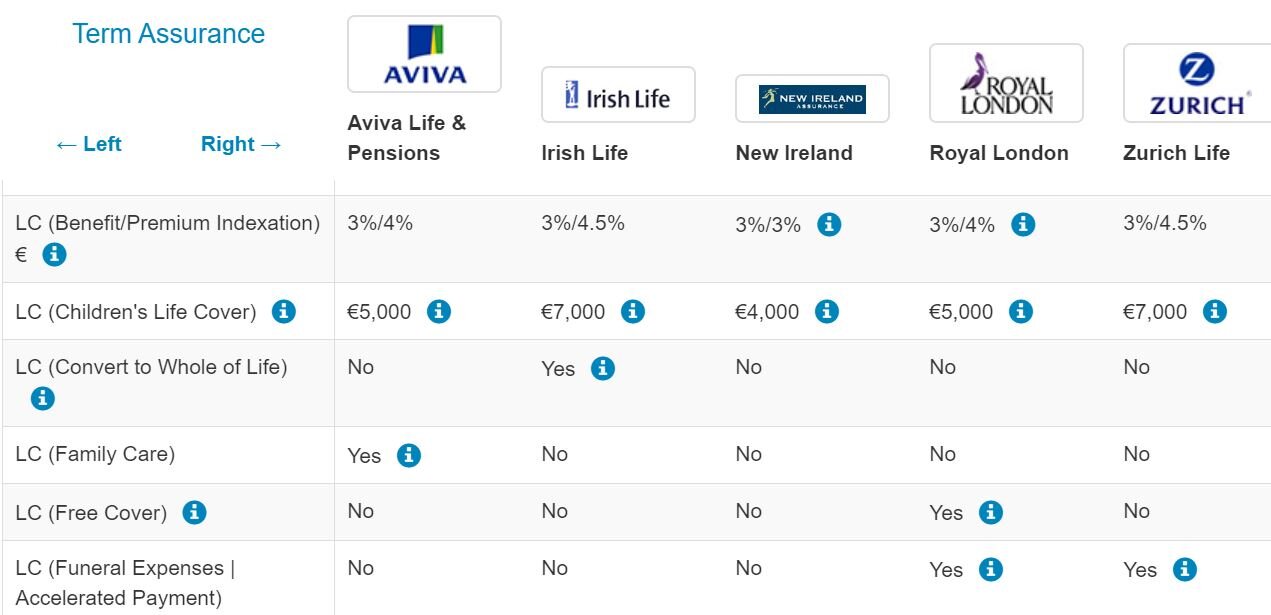

While we, at O’Leary Life, use multiple resources for comparing market products, this is a small screen shot from one of my favorite tools.

Brokers use these tools to compare policy terms and to access up to date rates for the cover you are looking for. A fact finding phone call or meeting will help the broker understand your circumstances, from income, outgoings, other cover in place, age of your dependents, years to retirement and the list goes on. The more information they know, the better they will understand your needs.

You might have plans to renovate your home and need a conversion option on your mortgage protection or be newly weds planning on growing your family in need of guaranteed insurability or a smoker planning to quit needing a smoker amendment conversion option -all of these would change the provider chosen.

I see many online-only brokers emerging in the Irish market and have mixed feelings around same. I fully embrace technology (like the tool above) and want to make life insurance (and all financial services) easier to purchase BUT that shouldn’t mean the consumer is handed the task of figuring out the details on their own.

I do not recommend purchasing a policy online end-to-end without speaking to a qualified adviser before clicking to accept -you could easily miss out on valuable policy features. I have touched on some of these above and while they may seem small, certain benefits can make a significant impact at a future date -one policy (or life company) does not fit all.

Finding the best policy is not rocket science but is about knowledge and access.

When talking with a broker, ask about their process, the reasons they chose the provider they’re recommending and be candid about your preferences.

We use online appointment scheduling and digital proposals to make getting a policy easy, the phone call is the most work you’ll have to do.

I highly recommend you take the time to call a broker and ask questions!

Author: Rachel O’ Shea, Protection Manager